-

How Much it ll cost to build an app like

- Cost to develop an Uber Tow Truck App

- Cost to develop a Pest Control App

- Cost To Develop a Handyman App Like Uber

- Cost To Develop a Doctor Appointment Booking App

- Cost To Develop An App Like MoodBites

- Cost To Develop An App Like SkipTheDishes

- Cost To Develop An App Like Q Chat

- Cost To Develop An App Like TickTick

- Cost To Develop An App Like ContractBook

- Cost To Develop An App Like Utter

-

How Much it ll cost to build an app like

- Cost to develop a Video Editing Mobile App like Magisto

- Cost to develop a Live Video Streaming App like Twitch

- Cost to develop an app like Home Workout- No equipment

- Cost to develop a Sports News app like theScore

- Cost to develop an Application like Reddit

- Cost to develop a Sports News app like theScore

- Cost to develop an E-learning platform like Udemy

- Cost to develop an On Demand Doctor App like Heal App

4 Ways Technology has changed Traditional payment for small business in Canada

Gone are the days when people have to depend on traditional payment methods, such as cash and cheques. Payment experiences have changed over the last 50 years. Several factors are responsible for the shift in the way we pay for goods and services, including, advancements in technology, desire for convenience, and security and regulations.

In the past, cash was mostly used as a means of payment. Then checks, which made it possible for bigger transactions and allowed people to carry reduced amounts of cash. Next, was the plastic credit/debit card that changed the game and gave us smaller wallets and a bigger purchasing power.

Today, a typical customer has various payment options. They can use cash, mobile wallets, or credit cards to pay. They can even use their smartphones by scanning a QR code. But despite these technological advances, a typical payment process became something bigger than itself – it became a vital part of giving consumers a unique shopping experience.

4 Ways Smart Technology has Changed Traditional Payment

1. Digital Payments/Mobile Wallets

With the growth of eCommerce and the need for secure payment options, online customers are embracing digital wallet payments as a payment option. These wallets have gotten more popular over the last few years, not only because of how secure they are but also because of their convenience.

To meet the changing preferences of buyers, online small business owners in Canada must evolve their websites and provide a smooth shopping experience. Although a mobile-friendly website is a major part of it, you also have to provide an easy checkout experience with various payment options. Consumers love easy checkout and alternative payment methods that fit their lifestyle.

Large companies have managed to make several billion dollars in market cap and are now considered the biggest influencers in the world. They and many companies like them have used Mobile wallets as a payment method, leveraging mobile wallet app development technology offering easy digital payment solutions.

2. EMV/Smart Cards

EMV will reduce credit card fraud coming from counterfeit. Also, the number of lost and stolen cards will reduce. This is because EMV cards keep payment data in a secure chip, and not on a magnetic stripe, and the personalization of EMV cards is carried out with issuer-specific keys.

It is easy to create counterfeit magnetic stripe cards, but it is impossible to make a counterfeit EMV card that can be successfully used to perform an EMV transaction. Additionally, EMV technology supports enhanced cardholder verification processes, which in turn have the potential to improve control of offline credit card transaction approvals.

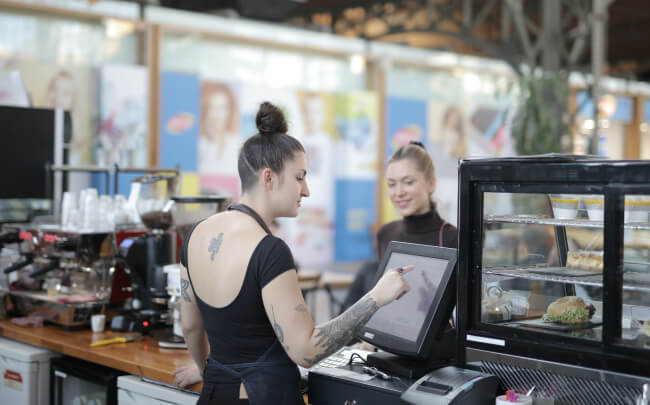

3. Mobile Point of Sale (POS)

A POS system is a fixed monitor having a touch screen to a cash register, telephone line, and central processing unit. It is the latest trend using a portable smartphone or tablet that works as a register for accepting payments.

With various payment options getting more popular, POS is for the customers who simply want to tap their phone and go. It has several benefits such as:

- Cost-effective

- Shorter checkout/return lines

- Lower business liability

- Easy setup

- Quick confirmation during payments

- Show the history of customers’ checkout

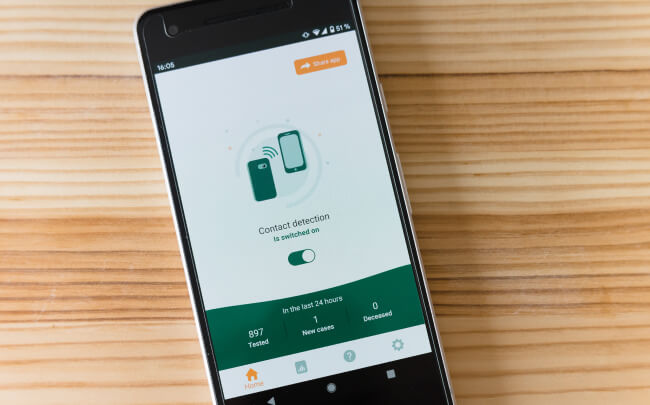

4. Peer-to-peer (p2p) Applications

Most P2P applications have risen to the occasion of providing consumers an easier way to send money. Even though one of the main uses of these applications is to transfer money between peers, some are allowing small business owners to accept payment from customers.

P2P applications integrate with other services to enable you to easily pay for them. These integrations have helped small businesses take advantage of this familiar payment method to enhance the customer experience.

Bottom Line

We have more efficient payment options today and technology providers will continue to look for ways to remove friction from this process. Payment technology has become quicker, secure, and fun. Technology innovations will keep on playing a major role in the evolution of payment and how customers buy online.

If you are starting a small business you could drop us an email at enquiry@letsnurture.ca with your questions on the new online digital payment system. We will get back to you as soon as possible.

Author

Our Partners

WhatsApp us