In the first quarter of 2020, Venmo’s net payment volume amounted to 31 billion U.S. dollars, representing a 48 percent year-on-year growth. The company had more than 40 million active accounts at the end of the first quarter of 2019.

Venmo is a free-to-use mobile payment app that lets users send money and receive it. The app is owned by PayPal and connects with bank accounts or credit cards of users and businesses to send and receive funds online, and is currently available only for users within the U.S.The business model of Venmo is a peer-to-peer money transaction service that allows users to link up their methods of payment and share transactions within their network. For regular or "end-users" consumers, Venmo charges only this 3 percent fee if they use a credit card for your transactions. Let's Nurture is a leading development company for mobile wallet apps, providing digital payment solutions and integration into business applications.If you feel like developing a mobile wallet app like Venmo to the end clients then we are here to give you technical approaches and advice along the way.

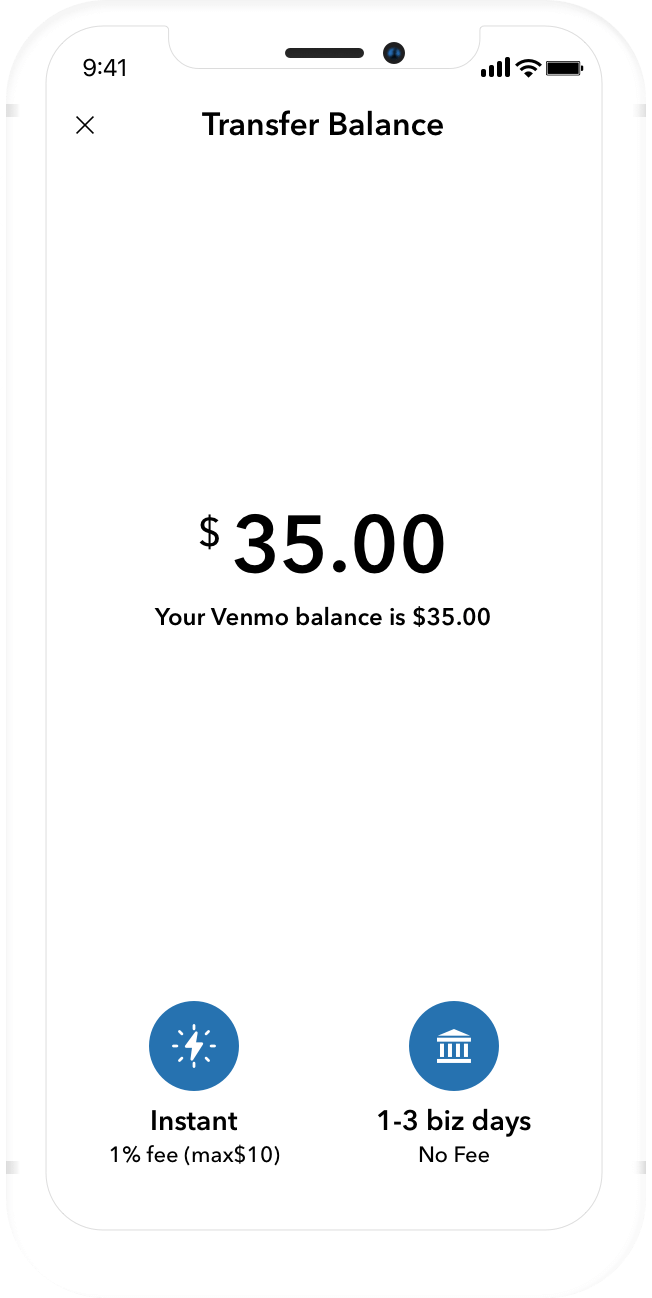

Venmo is a peer-to-peer (P2P) payment app available on iPhones and Android phones that allows people to swiftly and efficiently exchange money directly. Venmo was founded in 2009 and started as a text-based payment delivery system. The Venmo app has users connecting to their bank account, checking account, credit or debit cards, which they then use to complete requests to either send or receive money. Venmo users may "request" charges from friends or acquaintances in their network (that they can contribute, similar to Facebook-like social media apps). Once the request is sent, the person charged can either finish or deny the request (however the request's sender can also "remind" the person charged with their request). Upon transfer of the money, users can either hold the money as their "Venmo Balance" in their account or move it back to a bank account or credit card.

Users need a peer-to - peer application to transfer funds and obtain it in the easiest, most convenient and maybe even the safest way which paved several opportunities for businesses and business owners to grow. Mobile wallets grew after PayPal was hindering the payment industry. Growth in global smartphone production and increased internet infrastructure availability has only fuelled that growth.The outcome is now that the most firms providing financial services are mobile wallet app solutions providers from the sophisticated New York financial markets to the emerging Indian Technical markets.

Cost to develop a Mobile Wallet App like Venmo would be in the window of CAD 30000 to CAD 40000. Let us have a look at the bifurcation on feature-cost estimation for the Cost management app.

| 1. Digital Wallet: | Smooth processing, fast performance, protected transactions. Add your money to the wallet and make an instant payment. It’s the most useful when your bank server is on update and busy. |

|---|---|

| 2. Digital payments: | Via digital payment, you will be able to complete a transaction within seconds. You need to add your card and do the payment directly. Or, can add money to the wallet and make the payment. |

| 3. Two-factor Authentication and verification during the payment: | It acts as an extra layer of security to make sure you are the only person who has access to your account even when someone knows your password. |

| 4. Split bills: | Split your bills with your roommates and friends. This feature splits the entire bill among all the participants in the group, keeping a track of all the payments made. |

| 5. Mobile Recharge: | Recharge your prepaid mobile connection with us in less than 10 seconds. You can do an instant mobile recharge and win a chance to receive coupons and rewards. |

| 6. Bill Payments on time: | On-time bill payments for daily needs like electricity bills, water bills, etc. are now easy. Sit at home and make payments via a simple tap on your mobile. |

| 7. Offers and coupons on transactions: | Offers and coupons for the customers can be a powerful weapon to drive customers to loyalty. Customers can get special offers, coupons, and discounts on successful transactions. |

| 8. QR code payment: | You can simply scan the QR Code, given by the shipper, utilizing your smartphone. |

| 9. UPI payments: | UPI or Unified Payments Interface is a payment framework that helps with the transfer of money from one bank account to another in an instant. |

| 10. Maximum transaction to be done as per the bank rules: | All the transaction limits will be as per the bank rules or the regulations of the government. The platform can also set its limitation of the transaction for the day to be exchanged between two parties. |

| Users | Admin | |

|---|---|---|

| Add-on | Recharge and Bills | Verify Documents |

| Offers and coupon codes | Offer and Coupon Management | |

| Scan and Pay with QR code | Manage Recharges and Bills | |

| Payment Due Date Reminder | Dashboard Analytics | |

| Invite and Earn | Customer Analytics |

Digital payments manages per day transactions that are more than many ecommerce sites do in a month. Hence taking care of the security of these transactions becomes extremely necessary. The transactions can be encrypted into a shared ledger, using blockchain.

The transactions can be a perfect guide to evaluate the patterns in purchasing goods and services bought using your wallets. Using such machine learning algorithms in place, you can devise predictive techniques that are relatively reliable to help you exploit the trends while making unique offers.

We have Chatbot Development expertise and we can integrate with Venmo like applications which will support users with their requests and queries instantly. We build communication chatbots based on AI-ML that can be integrated for setting up Bill Payment Remainder and device flow.

Hire committed and expert android and iOS developers from us to see how distinctively they offer you a solution for a mobile wallet app like Venmo. The resources required for developing a mobile wallet app will include

With more than 10 years of experience in custom mobile app development,we help financial service companies deliver their digital roadmaps through deep knowledge, emphasis on innovation, cutting-edge technology, excellent design, and an understanding of each individual business case.Our Mobile Wallet App Mobile Wallet App Solution offers a rich portfolio of mobile financial services, including instant P2P payments, digital loans, savings , contactless technology (NFC and QR coding), simple and fast self-registration, split bill features, incentives, vouchers, discounts, budgeting , planning, and chatbots.

Experience with diverse security protocols essential for any wallet app.

Extensive experience with developing user friendly UX.

Consultation on strategic features and their development.

Multi-Currency & Multi Language development experience.

In house Legal experts proficient with international law for consultation.

Based on our initial assessment, developing and deploying an app like this typically takes around 20-25 weeks.

In the Venmo type concept, monetization can be integrated in multiple ways. Below are some approaches to consider:

Have an !dea to develop an app like Venmo?